Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

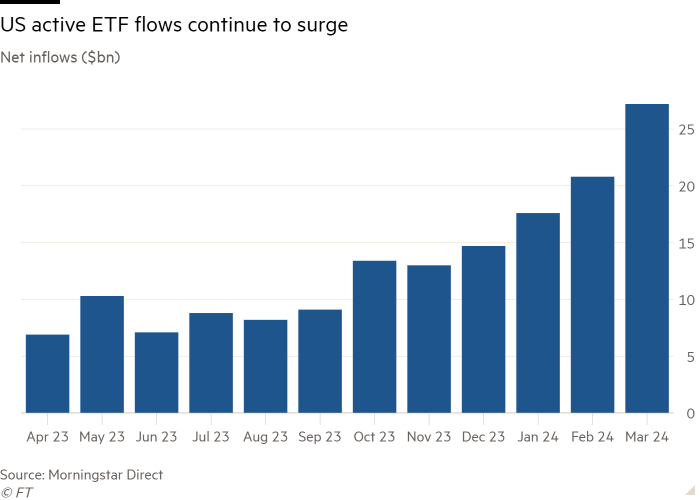

Flows to active US exchange traded funds have surged past previous records for both monthly and quarterly hauls, helping to drive assets held in the vehicles above $750bn at the end of March.

Investors pumped $65.6bn into active ETFs in the three months to the end of March — more than 50 per cent higher than the previous record of $41bn in the fourth quarter of 2023 — as assets under management in the vehicles rose to $758bn, according to Morningstar data.

The $27.2bn in flows garnered by active ETFs in March soared above previous monthly high water marks of $20.7bn, $17.6bn and $14.7bn, which were set in February, January and December, respectively.

The continued popularity of income-generating ETFs, active fixed income ETFs amid interest-rate uncertainty and financial adviser interest in core strategies from firms such as Capital Group and JPMorgan “give me comfort that adoption will persist the rest of the year”, said Todd Rosenbluth, head of research at VettaFi, a consultancy.

“Active ETFs used to be tied to Ark but it’s the more traditional asset managers that are the current winners,” Rosenbluth said, referring to Ark Invest’s spectacular run in 2020, which saw its actively managed Ark Innovation ETF amass huge inflows on performance gains of more than 150 per cent.

A BlackRock ETF run by the manager’s CIO of global fixed income, Rick Rieder, has led active fixed income ETFs in flows so far this year, garnering more than $2bn. BlackRock’s change in allocations in its popular model portfolios led to a surge on the equity side as well, according to Morningstar analyst Ryan Jackson.

“Active ETFs were all the rage in 2023, and a turn of the calendar hasn’t dented their popularity,” Jackson wrote in a note for Morningstar, referring to the $116bn in net inflows the funds pulled in last year.

Flows to actively managed ETFs were boosted by the launch in January of 10 spot bitcoin ETFs, which are classed by Morningstar as active vehicles. But even without their net inflows of $11bn in the three months to the end of March, active ETFs as a whole still attracted record amounts of investor money.

The strong flows to the most successful bitcoin ETFs — BlackRock’s, for example, attracted $14bn in Q1 2024 and Fidelity’s took in $7.6bn — combined with a rally in the price of bitcoin, which is up more than 50 per cent year to date.

Overall, active and passive ETFs pulled in nearly $195bn in the first quarter, with industry leaders BlackRock and Vanguard amounting for roughly half of those inflows. State Street, the third-largest ETF issuer in the US, suffered more than $3bn of outflows, while the fourth-largest, Invesco, garnered almost $22bn in net new investments, according to Morningstar.